Contactless trends are flourishing right now, around the world, as the general concept of “touch” is beginning to garner a negative image. Thanks to this, mobile wallet technology is evolving and is likely to dominate the tech world in 2021. So we decided to put together this read for our enthusiastic developer community.

Table of Contents:

#1 What is mobile wallet technology?

#2 How do mobile wallets work?

#3 Tips to create a mobile wallet that users will love

#4 How to make your mobile wallet app secure?

#5 Essential features for your mobile wallet app

#6 Popular mobile wallet apps to look at

#7 Curious to learn more? Check out these amazing related apps

What is mobile wallet technology?

Mobile wallet or digital wallet technology is, you guessed it, a virtual wallet technology that can reside on your phone as an app or a built-in feature. It stores your credit or debit card information and enable you to make contactless in-store payments at retailers that are listed with its provider.

When a user inputs payment information such as card details etc., the app issues a unique ID representing each individual card. This ID could be a number, QR code or some other unique key that is thereafter used to identify your source of funds when you next make a virtual payment.

How do mobile wallets work?

Now that we’ve got the basic premise out of the way, we can dive into the technology behind mobile wallets. Yes, the juicy part ☺️

So how do mobile wallets actually work?

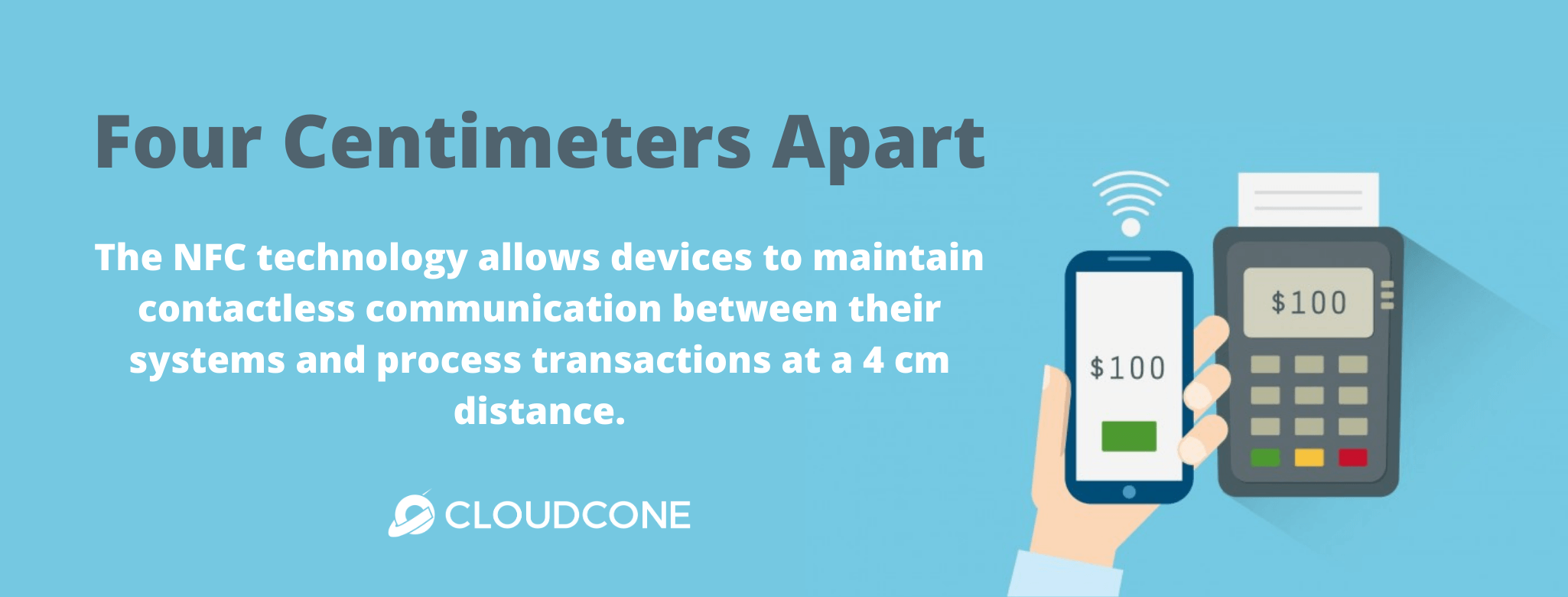

The key technology to keep in mind while looking at the functionality of mobile wallets is NFC or Near-Field Communication. Near-Field Communication is a communication protocol that allows communication between two devices that are as little as 4 centimetres apart from each other. The idea is to use NFC to enable communication between a user’s smart device and a POS (Point-Of-Sale system).

With the 4cm distance margin, it requires no physical contact between the two systems to validate a transaction.

Tips to create a mobile wallet that users will love:

As an emerging market mobile wallets have so much room for innovation and creativity but the ultimate goal is to create a mobile wallet app that users will love and use regularly. Here are a few tips to keep in mind throughout your development process:

#1 Convenience

Making payments is generally a subject of stress and tension for just about anyone. Make sure your app doesn’t amplify this mood but rather acts as a pacifier. keep your UI and UX super simple with easy navigation, clear instructions, clean and minimalist design and simplified processes.

#2 Processing speed

Another important feature when it comes to being efficient is speed. Make sure you host your mobile wallet app on super fast servers and streamline the transaction process so that it flows smoothly from one task to another.

#3 High security

It goes without saying that mobile wallets require the highest possible security. As apps that deal regularly with sensitive user data and finances, it can become an easy target for malicious activities. Get security professionals or your security team involved in the app development process. It will also be incredibly useful to have most of the possible attack scenarios figured out. Think like a malicious party would and list down the possible threats that the app can encounter.

How to make your mobile wallet app secure?

Here are a few pointers for creating a secure mobile wallet app.

#1 Use secure coding practices for your mobile wallet

For a start make sure that attackers cannot reverse engineer your code. The best way to do this is by keeping your app vulnerabilities to a minimum. Test your code regularly and minify it to eliminate the chances your attackers have of tampering with your app. Constantly check for bugs and eliminate them too.

#2 Keep an eye out for unauthorized APIs and third-party libraries

Anything external can be a source of malicious attacks. Use APIs that are authorized using an API Hash and an Authentication Key from a central server. Make sure to also test the codes of your libraries thoroughly before use.

#3 Encrypt your mobile wallet app data

Encryption is a powerful data securing technique that is unbreachable even by the most skilled hackers. You can use any method from symmetric key, asymmetric key, cryptographic hash function, and digital signature.

#4 Go easy with the app permissions

This is also known as the “Principle of least privilege“. The basic idea is for you to ensure that your app runs with the minimum app permission requirements. If your app doesn’t absolutely need to connect with a certain element of the device, don’t ask for permission to connect. More connections mean more inlets for attackers.

Essential features for your mobile wallet app:

When creating apps like mobile wallets that people involve heavily in day-to-day life, including these few key features in your project will make it handy for your users.

#1 Instant over-the-counter payments

This one is obvious. It’s the core functionality of a mobile wallet. Make sure your app uses NFC technology as mentioned previously to complete shopping transactions with point of sale systems. This also means that you enable the feature to allow instant payments between wallets in general. If you need to pay a person rather than to a POS system, your mobile wallet app should allow the transfer of money from the paying wallet to the receiving wallet.

On traditional terms one would actually take a few business days to complete this task. This is because the party that makes the payment needs to make the cash transfer directly from a bank. But mobile wallets have fixed time and efficiency issues with the instant payment feature.

To make your app stand out among competing mobile wallet apps, observe competing apps and pick up on what they lack and what they could have done better. Jump to the bottom of this post for a list of currently popular mobile wallet apps in the industry.

#2 Instant bill payments

Paying utility bills, rents, mortgages etc. can be a hassle. FinTech experts around the world advise that mobile wallet app developers can use this opportunity to create a convenient process for completing such tasks.

Similar to the previous feature, on traditional terms this process would end up taking up to days. Mobile wallet apps can help reduce this down to a matter of minutes or even seconds.

#3 Managing cards through your mobile wallet app

In addition to various types of payments, mobile wallet apps are also great platforms for storing and managing physical cards. This is mainly thanks to the fact that it’s much more secure than carrying your cards around all day as easy targets of theft.

Mobile wallets don’t store intelligible credit and debit card details. Design your app so that it scans that information from physical cards and encrypts the data before storing it. This means that your credit card details have fewer chances of being stolen and used for malicious purposes.

When creating your mobile wallet app make sure that you include management options for cards operations, including but not limited to block/unblock, change PIN etc.

#4 Split the bill feature

But a great mobile wallet app will!

Mobile wallet app users adore this feature because it saves them time and spares them from having awkward conversations about money with their friends. When a user of your mobile wallet app has a meal at a restaurant with a group, they would use this feature to share the total bill with contacts in their phone. The contacts will then transfer the amount they each owe to your user’s wallet. This makes going cashless that much easier for your mobile wallet users.

#5 Financial health tracking

Analytics adds a unique touch to your mobile wallet app by allowing users to trace and manage financial health. This helps users meticulously plan our their savings and spend their money wisely.

This feature could include all kinds of information. For instance, graphs and charts can be utilized to view how the user has been spending money over a period of time. Warning systems can be employed to alert users when their financial health is at risk. It can also showcase payment histories and when and where a user has the tendency to spend more.

You can obviously get creative and interact your app design and layout concept to deliver a truly convenient and pleasant experience for your users. Adding a budget planning system to this feature is one way you can get creative and help your users better manage their finances for future expenses.

Popular mobile wallet apps to look at:

Creative freedom is a huge advantage when it comes to delivering a quality product, whatever it may be. But it helps to take a look at the industry standard. After all, you can’t beat the standard without knowing the standard 😎

Here are a few popular digital wallet or mobile wallet apps:

#1 Cash App

Cash App is one of the most secure mobile wallet apps around. And this is because your credit and debit card information which, upon entry are converted into tokens, are thereafter only ever accessible through fingerprint.

Cash App has a feature that they’ve named Wallet. This feature allows you to store movie tickets, boarding passes, concert tickets, coupons and loyalty cards. Much like a real wallet would!

#2 Venmo

This app is owned by PayPal and is a popular p2p or peer-to-peer payment app used worldwide. All you’ve got to do is link a friend’s card or check account to start paying or receiving money. Using Venmo you can also share your transactions as messages on Facebook, Twitter or even Foursquare.

#3 Dwolla

Dwolla allows you to transfer money to or request money from any party within the U.S, using their email address or phone number. The digital wallet feature on this app also allows you to store data that are crucial in processing transactions fast- which is usually within a day. And all of this for little to no transaction fees! Dwolla even allows you to customize the app to best fit your needs with its intuitive API.

Curious to learn more? Check out these amazing related posts:

Create the ideal cloud environment for your multiple app/web development projects with dedicated resources and DRaaS. Read up on our private cloud solution.

Deploy apps like GitLab and Docker in one click to run your projects. We introduced our one-click applications in August 2020 so that you’re able to work on your projects much more smoothly. Here’s all you need to know about one-click apps.

It’s not just mobile wallet apps that have seen a rise. Healthcare and related fitness app have been seeing the same trend recently. Here’s how cloud computing can facilitate the growth of global healthcare in 2021.

About The Author: Anu

Content Strategist at CloudCone LLC.

More posts by Anu